Each ETP in the batch must be a single transaction for that employee. You cannot run a normal or other pay for the employee in the same batch as the tax cannot be reported in the Single Touch Payroll file.

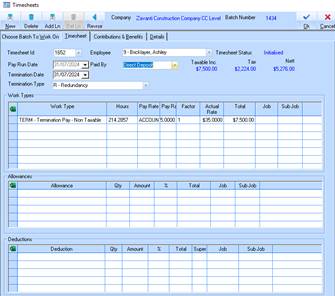

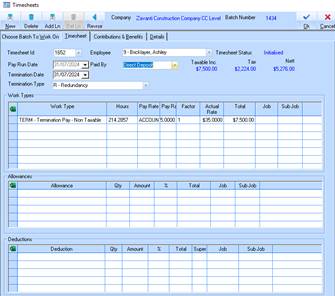

1. Select the Employee and edit the timesheet for that employee by deleting any lines existing in their standard timesheet if being used.

2. Enter Termination Date – this will update Employee properties and set the Final Event Indicator in the STP file.

3. Add Line and Select the Termination PAY Work Type(s)

4. Enter the Termination Pay amount

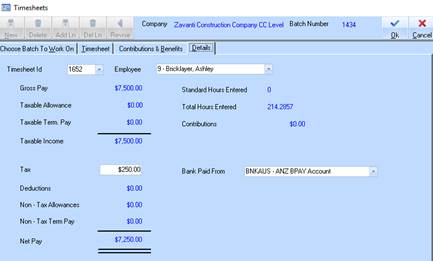

5. Calculate the TAX (externally) as per the ATO Guidelines and enter it manually on the DETAILS TAB as shown

6. Finalise the Pay run as per normal process

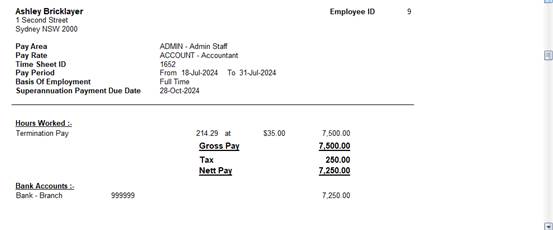

7. See example of payslip below

8. Generate the STP file as per normal STP file instructions, if this is the final payment to the employee you need to select Final Event Indicator when creating the STP file.