This option is to be used in order to generate the necessary electronic ‘Tax Payments annual report’ (TPAR) file for lodgement with the ATO.

Please note that the ATO has very specific requirements for the data held within this file. Any errors or invalid data detected in the file by the ATO submission website will cause the entire file to be rejected.

The following errors will cause the file to be rejected.

•ABN missing from Company record

•ABN missing from Supplier record

•Payee non individual name field must be completed when Payee surname or family name and Payee first given name fields are blank.

For further information please review the ATO website.

This information is maintained in Zavanti Company and Supplier record maintenance. Please ensure this data is complete for ALL suppliers to be reported, before processing the ATO Electronic file option

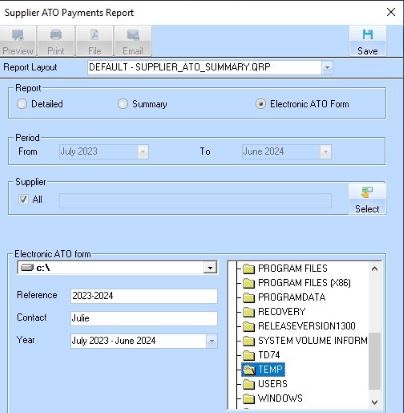

A filter has been provided to enable the user to select a specific ‘YEAR’ for the production of the Electronic file. This is ONLY allowed to be for one year

A filter has also been provided to allow the user to select a specific or multiple suppliers to be included on the report

|

Note |

Only suppliers that have been set to “ATO Reportable” as shown in Supplier maintenance will be able to be selected on this report. |

1. Enter a ‘reference’ in the field provided. This field cannot be left blank

2. Enter a ‘contact’ in the field provided. This field cannot be left blank

3. Select the financial year using the drop down selection arrow in the field provided.

4. Select the location where the file is being saved. It is essential to note down where you are saving the file. The file created will be named “TPAR”.

5. Click on the Save button to create and save the file.

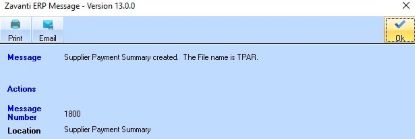

6. Once complete and saved the message will appear.

7. This file can now be lodged with the ATO. For information on the electronic lodgement of the ‘Tax Payments annual report’ (TPAR) file please refer to the ATO website, or contact the ATO directly http://www.ato.gov.au