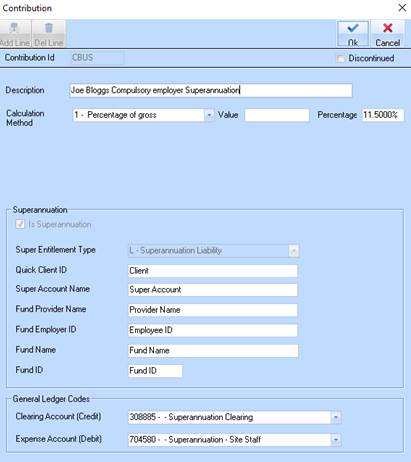

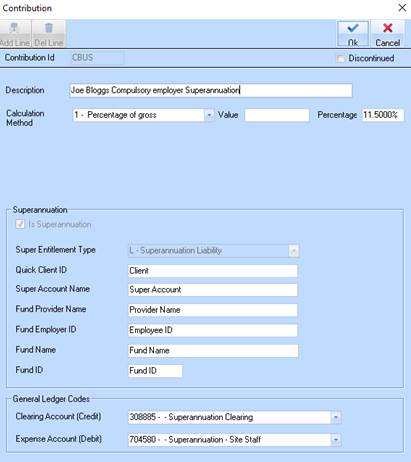

A ‘Superannuation’ contribution is to be set up as the Employer Guarantee Contribution at the 11.50% which currently legislated by the Australian Government.

Fig: 1 – Payroll Contribution maintenance window

In order to set up this type of Contribution, the ’Is Superannuation” must only be checked as this will report as the Employer Guarantee Contribution, as shown in Fig: 1

Reportable employer superannuation contributions are additional to the compulsory contributions you must make. An example of a reportable employer superannuation contribution is a contribution made on your behalf under a salary sacrifice arrangement.