A user can use “Adjusting Journals” to adjust the Prime Cost for future depreciation calculations.

Previously, when applying a debit or credit journal to a Prime Cost Depreciation asset item, would not adjust the amount of subsequent depreciation calculated.

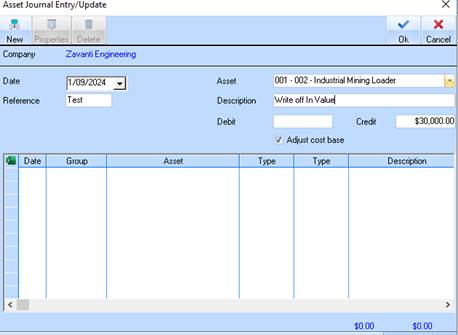

The user now has the ability, when creating a debit or credit journal, to tick a box indicating that the journal will be taken into account when calculating the depreciation.

Please note the following parameters –

1. Will only be applicable to Prime Cost Depreciation assets.

2. Diminishing Value assets will not have this option available, and any journals transacted against the assets will be factored in the subsequent years’ depreciation calculation value (no change to existing functionality).

3. To apply this you should select the new option “Adjust Cost Base” when creating an adjusting journal.

4. Where the ‘Adjust cost base’ is not ticked for a journal, the WDV for that asset will be adjusted but depreciation value will not (no change to existing functionality).

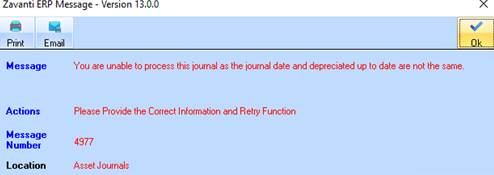

5. Date of Journal must be the same as the last depreciation run date for that asset. This is to ensure that no incorrect depreciation values are written off against a period not relevant to the journal. Attempts to add a journal to an asset where dates do not match will receive the following error message.

This functionality will allow users to write down or write up the value of a prime cost asset, and have it factored into depreciation calculations automatically.

Previously, to achieve the same result, users would have had to dispose of an asset and reacquire it, at its adjusted value, to get the correct depreciation value applied.