In this example we are repaying Facility 1 from Facility 2 e.g. Transfer of Funds from Facility 2 to Facility 1

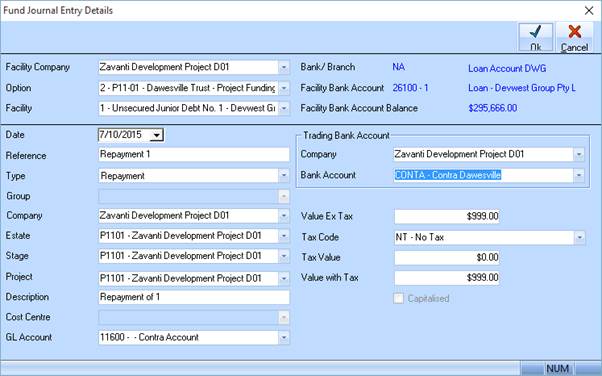

1. Select the Facility you want to “repay” (i.e. Transfer TO Facility 1)

2. Select the CONTRA ACCOUNT Bank account and GL account.

(This is because if you select a FACILITY here, it WILL NOT adjust the Funding balances, must be done in steps 6 onwards)

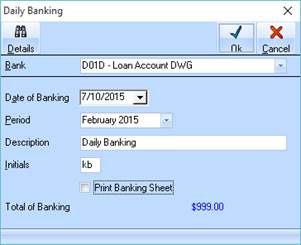

3. This will create a receipt in the facility bank account which you must do daily banking for the receipt to be posted to facility 1 bank account cash book (d01d)

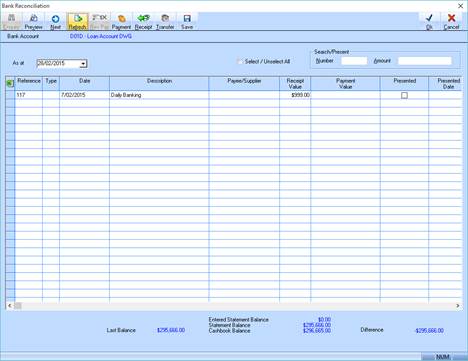

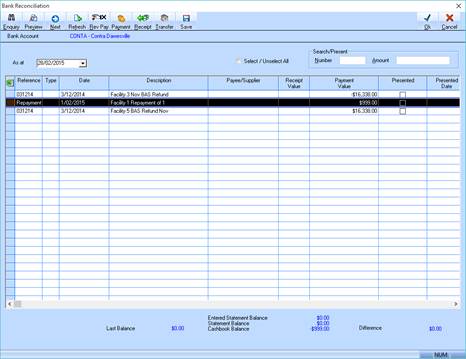

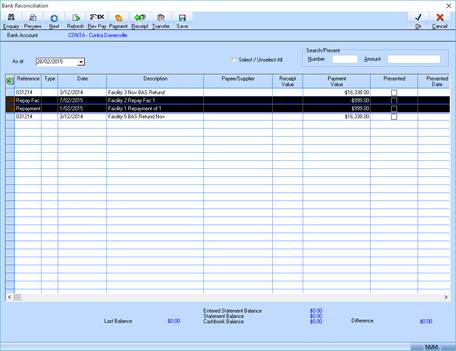

4. We now have a receipt in the facility 1 bank account as shown.

5. And a payment in the contra account as shown.

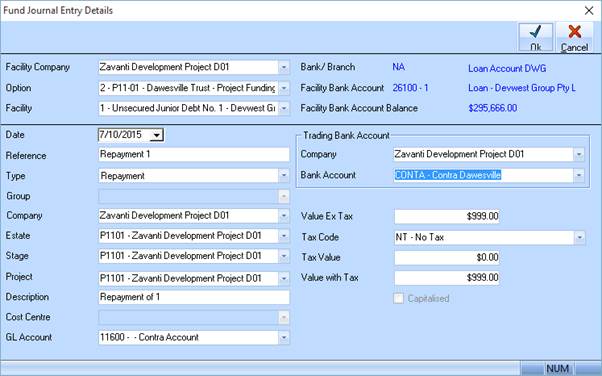

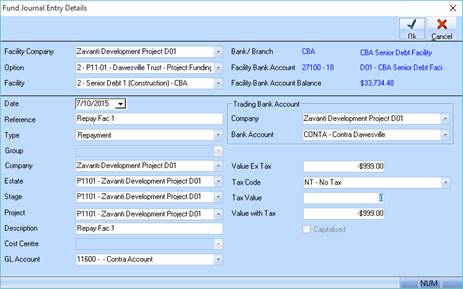

6. Now create the other side of the transaction to affect the facility 2

7. Select the facility you want to “repay” from ((i.e. Transfer from facility 2)

8. Select the CONTRA ACCOUNT Bank account and GL account

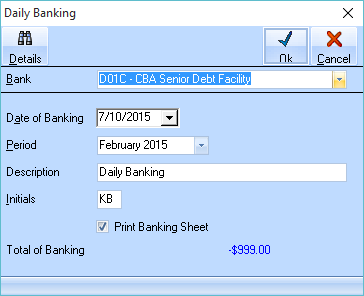

9. Enter a NEGATIVE value

10. This will create a ‘negative’ receipt in the facility 2 bank account which you must do daily banking for the receipt to be posted to facility 2 bank account cash book (d01c)

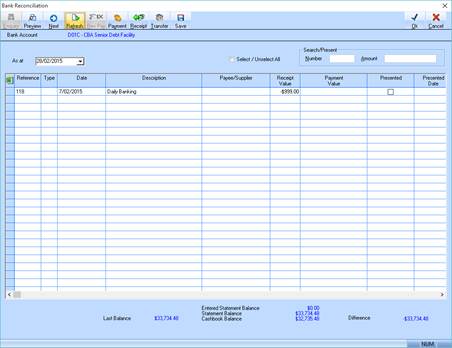

11. We now have a ‘negative’ receipt in the facility 2 bank account as shown

12. And a ‘negative’ payment in the contra account as shown, (offsetting the payment)

|

Account |

Sub A/C |

Dept. |

Account Name |

Period |

Source |

DR |

CR |

|

26100 |

1 |

|

Loan - Developer Group Pty Ltd |

201502 |

CBREC |

$999 |

|

|

11600 |

|

|

Contra Account |

201502 |

CBPAY |

|

$999 |

|

23120 |

|

|

GST Paid (AP) |

201502 |

CBPAY |

|

$0 |

|

27100 |

18 |

|

D01 - CBA Senior Debt Facility 1188-1826 |

201502 |

CBREC |

-$999 |

|

|

11600 |

|

|

Contra Account |

201502 |

CBPAY |

|

-$999 |

|

23120 |

|

|

GST Paid (AP) |

201502 |

CBPAY |

|

$0.00 |

13. The resulting journals show nil effect on the contra account, and the 2 facility bank account adjusted correctly