Zavanti will control leave entitlements (Annual, sick, LSL RDO etc) for employees with payroll for each employee. You can also have Zavanti record the regular journals to record the liability and the payments to employees from this liability.

You have options for recording these liabilities and payments against them.

1. First – you can manually reconcile and do regular journals to record the leave liabilities based upon reports within the Payroll module.

2. Alternatively, you can have Zavanti record the accruals based upon each pay run direct to the General Ledger.

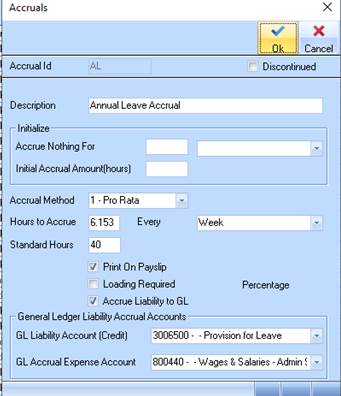

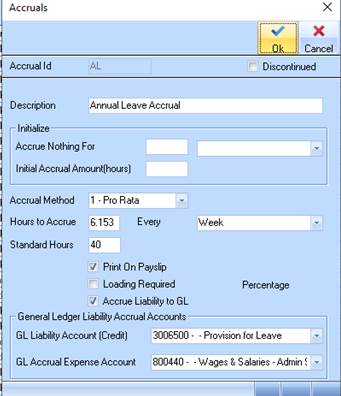

3. If you select this option, automatic recording, you must set up the Accruals Work Types to Accrue to General Ledger – see below – select ‘Accrue Liability to GL’ then enter relevant accounts for posting.

4. Having made the accruals to your General Ledger each pay run you have 2 alternatives to adjust the liability for actual leave taken.

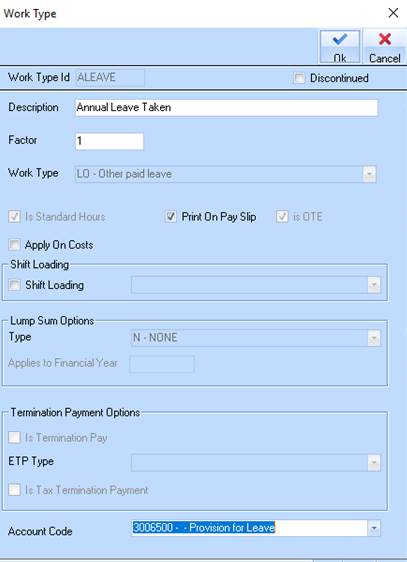

5. Firstly, this can be done by the system when coding the work types for leave payments. Code work type payments to go to the General Ledger Liability account.

6. Secondly, you can do monthly journals to adjust based upon you monthly pay run reports, in this case you would code the Work Type payments to go to the Profit and Loss account and then manually review and adjust each reporting period (month).