This process reduces the gross earnings for the employee by the amount of the sacrifice and transfers this amount to superannuation.

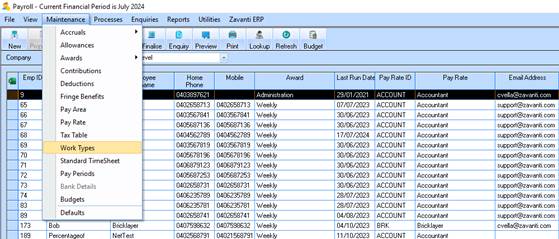

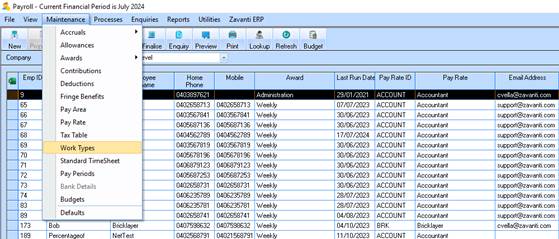

1. In the Payroll Module, create a new 'Work Type' from the Maintenance menu selection on the front window (e.g. Code – SALSAC, Description - Salary Sacrifice)

2. If the Payroll Module is integrated to the General Ledger Module, the default General Ledger account is the relevant Wages Expense account that the Employee’s wages are to be expensed to.

3. Create a new Work Type from the Maintenance menu selection on the front screen in the Payroll Module.

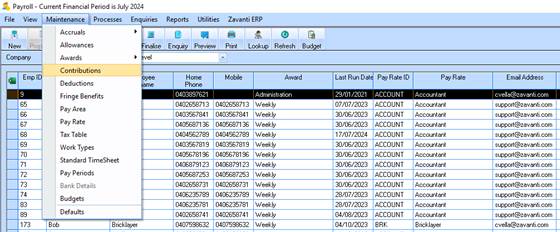

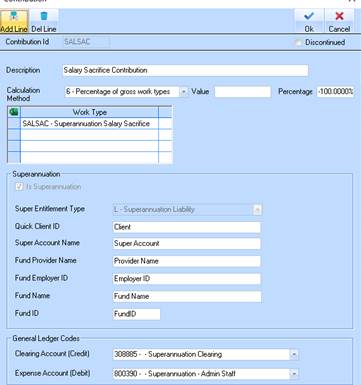

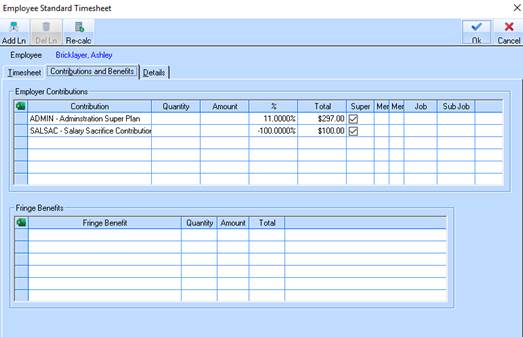

4. Create a new Contribution from the Maintenance menu selection on the front screen in the Payroll Module.

5. The Calculation Method is Flat Amount ($).

6. The rate that is to be entered is the amount equal to the fixed amount of the salary sacrifice for the pay period (e.g. $100 per week).

7. If the Payroll Module is integrated to the General Ledger Module the Clearing Account (Credit) would be the Superannuation Clearing Account and the Expense Account (Debit) would be either the Superannuation Expense Account or the Wages Expense Account.

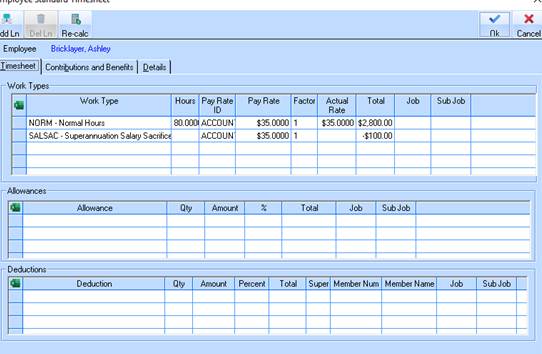

8. Alter the Standard Timesheet for the Employee by adding the New Work Type

9. The Pay Rate ID cannot be changed at this point.

10. Add to the standard timesheet the Contribution

11. After initialising a payroll batch the Pay Rate ID will need to be changed on the relevant employee’s time sheet.