Sometimes it may be necessary for a user to reverse a receipt, whether it was incorrectly processed or a cheque was rejected. This FAQ is designed to step a user through processing a negative receipt matched against the original receipt to cancel it out.

The process is quite simple

•Enter a negative receipt

•Match the positive and negative transactions

1. Open the Accounts Receivable module

2. Click on Transactions > Receipts

3.

Select the relevant options (Automatic Banking, Print Receipts/Batch Listing)

and enter a Control Total. This should be the amount of the receipt to be

entered, and it should be a negative number.

For example, if the receipt to

be reversed is to the amount of $100, the value in the control total should be

-$100

4. Press Receipt

5. Select the appropriate Date and Period for the reversal. Ensure it’s the same period as the original transaction.

6. Enter the (negative) amount of the reversal into the Amount field.

7. Select the appropriate Pay Type

8. Press New

9. Highlight the appropriate client and press OK

10. Click Make Pre-payment

11. Enter a description (e.g. “Reversal) and press OK

12. Press OK.

13. Press OK again to post the receipt

14. Press Yes to the confirmation window

15. Close the Cash Book Receipts window to return to the main screen of the module.

16. Matching the positive and negative transactions

17. Find the relevant client’s name in the main window of Accounts Receivable and double click it

18. Press All to view all of the transactions

19. Determine

which transaction it is you need to reverse, and locate the transaction in the

list. (You may need to select “All” in the Transactions radio button

group.)

If the original receipt has already been allocated to an invoice, and

you wish to have the invoice outstanding again, you will need to select the

original invoice. If the original receipt was entered as a prepayment (and not

allocated against an invoice) you will need to select the original receipt.

20. Highlight the transaction to be reversed.

21. Holding the Ctrl button on the keyboard, locate the reversal receipt entered earlier, and click on it to highlight it.

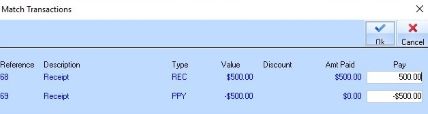

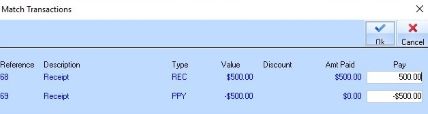

22. Press Match. The Match Transactions window will appear.

23. Enter the

appropriate amount into the Pay column.

For example, in the screenshot above

there is a PPY for $100 to be reversed. This transaction needs to have an amount

of $100 in the “Amt Paid” column so it balances the value i.e. Value = $100, Amt

Paid = $100, Difference = $0. Therefore, the amount to enter into the “Pay”

column is $100.

24. A figure

will be automatically entered into the Pay column for the remaining transaction.

This should equal 100% of the Value for that transaction.

E.g. entering $100

into the Pay column for the second transaction automatically entered -$100 into

the Pay column for the first transaction. Press OK

25. The

reversal will be processed.

If an invoice was selected to be matched against,

the invoice should now be outstanding. If the reversal receipt was matched

against a receipt not allocated to an invoice, then both receipts should be

marked as reconciled.