4. Still in the Payroll module, click Maintenance > Contributions.

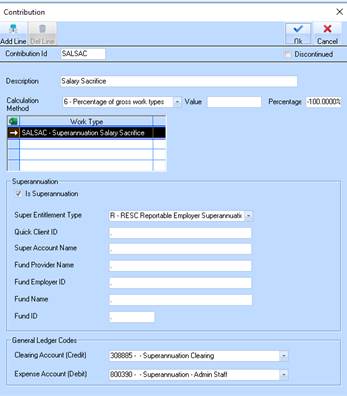

5. Click New to set up the new Contribution. The following window will appear, enter the appropriate information as described below:

|

Field |

Description |

|

Contribution ID |

Unique description to describe the contribution e.g. SALSAC |

|

Description |

A description of the contribution |

|

Calculation Method |

Select 6 – Percentage of Gross Work Type. This option allows the contribution to be set to particular work types only i.e. no other work types paid to the employee will be affected by the contribution, other than those selected in this window. |

|

Percentage |

Enter a figure of -100 (negative 100). Whatever value is applied to the employee for their sacrifice will be automatically applied to this contribution. As a work type, a salary sacrifice is already a negative in gross earnings. The contribution needs to be a positive, so a negative figure (work type) combined with a negative percentage figure will result in a positive contribution. |

|

Work Type |

Press Add Line and select the work type created |

|

Is Superannuation |

Tick this Field to open up relevant data fields. For Salary Sacrifice select ‘R’ RESC Reportable for Super Entitlement Code. Super The Super details are optional but if not entering specific details just enter a ‘.’ |

|

General Ledger Codes |

These codes should be the same as nominated for the work type i.e. the Superannuation Liability account. Ordinarily, the nominated superannuation accounts would debit the superannuation expense and credit the superannuation liability (for payment to the employee fund). However, because of the nature of salary sacrifices, the company in fact does not incur an expense and thus no debit to the expense account. The effect of both GL nominated accounts in the Contribution setup effectively has a null effect on the General Ledger, while the Work type account (which is in reality a negative debit, thus a credit) has shifted the salary sacrifice value from the employee’s net payment to the super liability account where it is to be paid out. |

6. After entering all the information, press OK to save the Contribution.

7. Close the Contributions window.