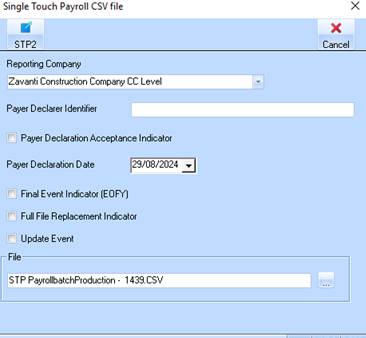

The creation of the Single Touch Payroll file will now be the last step in the finalise batch process.

You will continue to process your payroll batches as normal checking all data, emailing etc.

When you are asked the question ‘Do you wish to finalise and answer ‘Yes’ the user will be taken to the create Single Touch Payroll file function.

The Single Touch Payroll process allows for the selection of an alternative 'Reporting Company' where the logged in Payroll entity reports under a different Reporting Company to the ATO. This alternate reporting company must exist in the Zavanti database. The functionality will allow for the Reporting Company Name, Details and ABN number to be used in the file uploaded to the Australian Tax Office. By default the 'Reporting Company' will be set to the logged in Payroll entity. The user can select a different 'Reporting Company' from the STP reporting window if required.

|

NOTE |

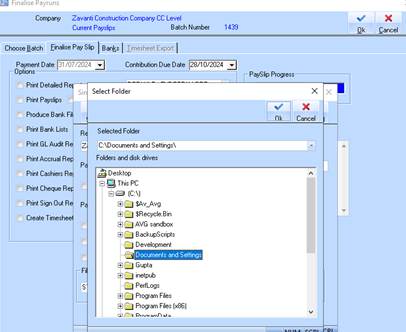

If you do not want to create the STP file at this point, or are not required to do so, click ‘Cancel’ and your Payrun process will now be complete |

The Payroll Batch number will be assigned the actual batch number and should not be changed.

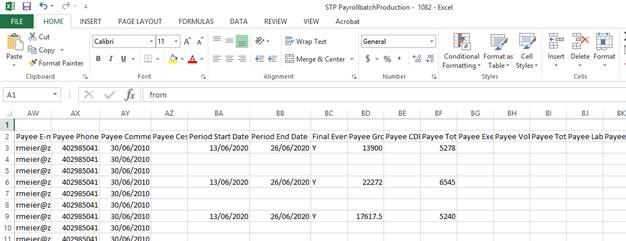

1. Enter Payer Declarer Identifier (Name of person lodging the file)

2. Select the “Payer Declaration Acceptance Indicator” to confirm that you have authority to create and lodge the file

3. Final Event Indicator – this is to let the ATO know that this is the final payroll file being lodged for the tax year for those employees in the batch.

4. Full File Replacement Indicator – this is in the unusual circumstances when you re-lodge a STP file to correct some errors, note that this will NOT make any changes to the amounts reported, only updates will be in additional information. Normally these would be reported in the next file being lodged.

5. The update event allows the employer to report changes to employee YTD amounts previously reported. The update event may only be used in circumstances other than when the employee is paid.

6. You can change the destination path for the file if desired, the default path is the same as your payroll reports default path. Using the location look up button to nominate an alternative file location.

7. Use the location lookup box to nominate where to process the file

8. Select your nominated location and click on OK

9. Your selected location is now displayed in the ‘File’ box

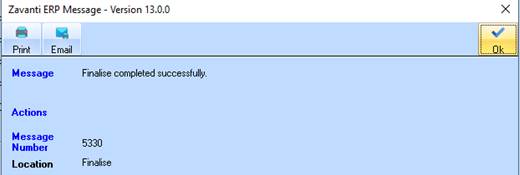

10. Click on the STP2 button in the top left hand corner to generate (create) the CSV file

11. File has now been created message is displayed.

12. Batch is now finalised.

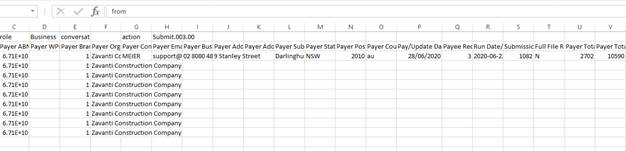

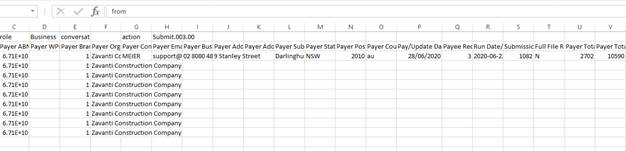

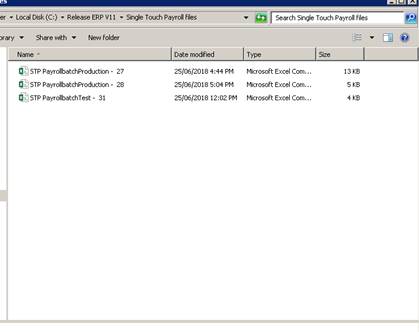

13. Navigate to your file location and files will be displayed

The file can now be submitted.

|

NOTE |

DO NOT open this file or the format will changed and will not be accepted by the ATO. If you want to look at the file copy it and paste to your desktop where you can open the CSV file in Excel. |

|

NOTE |

Please refer to ATO website for additional information on the requirements for these fields. Failure to comply with the above requirements may result in rejection of the STP file upload |