Allowances will be reported for ATO reporting on the basis of the combination of selections when setting up your allowances. These selections cannot be changed once the Allowance has been created.

The selection options are:

•Taxable – do not Print for Tax Reporting

o Allowance will be added to employee’s gross pay in STP file

•Taxable – Print for Tax Reporting

o Allowance will be shown under allowances in the STP file

•Non-taxable - Print for Tax Reporting

o Allowance will be shown under allowances in the STP file, but no tax withheld

•Non-Taxable – do not Print for Tax Reporting

o Allowance is not included in any report

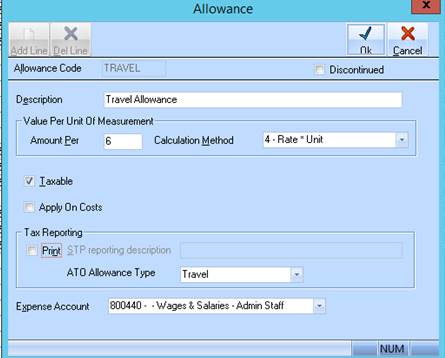

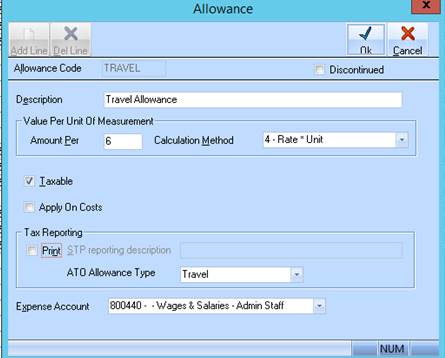

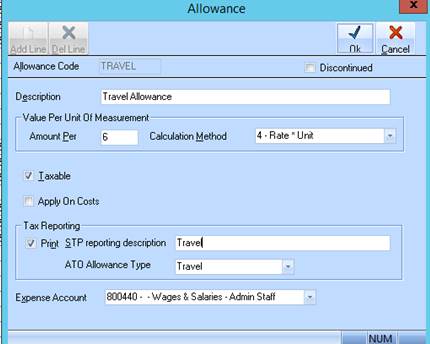

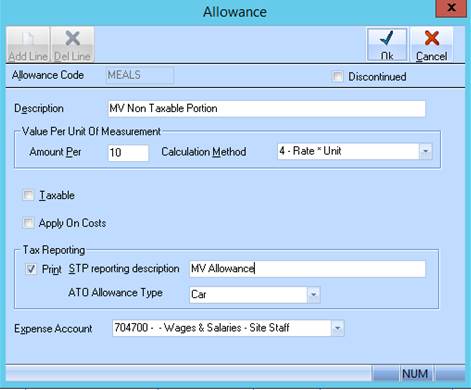

Examples of these options are shown in the screen shots below.

•Taxable – do not show report as allowance for Single Touch Payroll, the amount is included in the employee’s ordinary earnings.

•Taxable –show as an allowance in your Single Touch Payroll report

•Non-taxable - show as an allowance in your Single Touch Payroll report, but no tax withheld

•Non-Taxable – do not show on Single Touch Payroll report