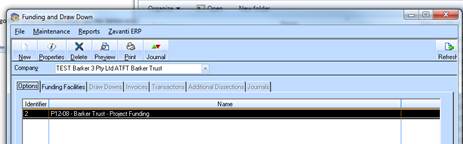

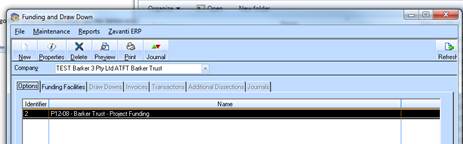

1. Select the entity

2. Highlight the Project under the options tab and the funding facility tab will become available to view.

3. Click on Funding facility tab, highlight the facility you want to create the draw down from and go to the Draw Down Tab and click new.

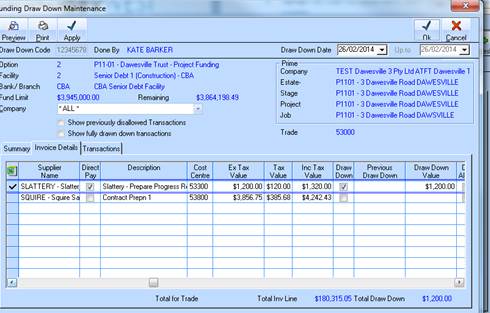

4. Enter in Draw Down Code – Next Draw Down number eg. 8

5. Highlight the trade/trades you would like to select invoices from to pay and the invoice details and transactions tab becomes available.

6. Go to the invoice details tab and the following options are available:

•DIRECT PAY - This marks the creditor as paid.

•DRAW DOWN – This reduces the facility – Credits the GL Account

•DIS ALLOW - Ignores transactions to not be included in draw down

7. OPTION 1 – This is when the bank pays the contractor and supplier

•Tick Direct Pay

•Tick Draw Down

•Cr Facility & Dr Trade Creditors

8. OPTION 2 – This is when the bank transfers the money into Project bank account, Project then pays suppliers

•Tick Draw Down

•Cr Bank & Dr Facility

9. Type in amount to be paid net of GST under the column that says draw down value as per below:

10. Go back to the summary screen and the invoices draw down column should equal what needs to be paid for that payment/draw down.

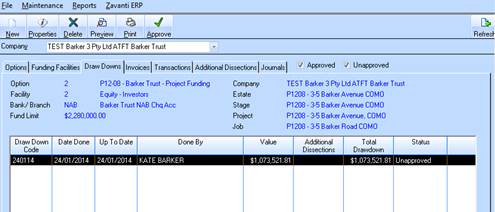

11. Click OK

12. New Draw Down should now pop up under the Draw Down Tab.

13. Draw Down needs to be approved – click on approve button and the below screen will pop up.

14. Untick Print confirmation select bank account which relates to the fund you are drawing from.

15. Once approved the journals will be posted into the GL as per OPTION 1 & OPTION 2 above.