In order to verify the data on the CSV file (which can be edited using MS excel), an Employee transaction listing can be produced for the selected employee(s).

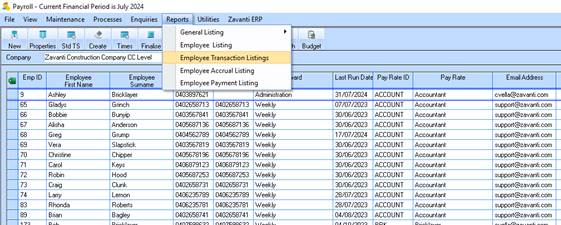

1. On the Payroll Main Menu select Reports > Employee Transactions Listing.

Fig 15 - Reports > Employee transaction Listing

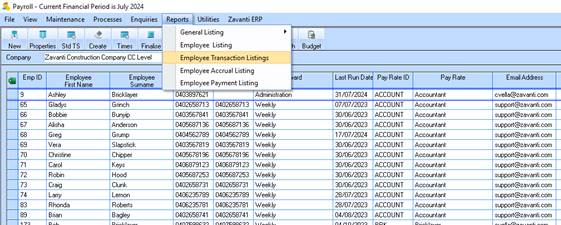

2. The following selection options from the report screen should be selected in order to produce a valid report to reconcile back to the data on the CSV file generated. (See Sample Contribution CSV file topic=Sample Contribution CSV file)

Fig 16 - Employee transaction listing selection window

3. Select the ‘From’ and ‘To’ Reporting to dates to match the CSV file generation.

4. Ensure ‘’Include Terminated Employees” is checked.

5. Select “All” selection options for :

•Employees,

•Pay Areas,

•Jobs,

•Cost Centres.

6. Uncheck

•Work Types

•Allowances

•Fringe Benefits on the right side.

7. Select any Deductions and Contributions that are reportable.

It is possible to have Contributions and Deductions that are not relevant to Superannuation. An example of this might be Salary Sacrifice for a Computer or Motor Vehicle. These of course are not reportable as superannuation contributions, hence the necessity to be careful on selection of relevant Contributions and Deductions.

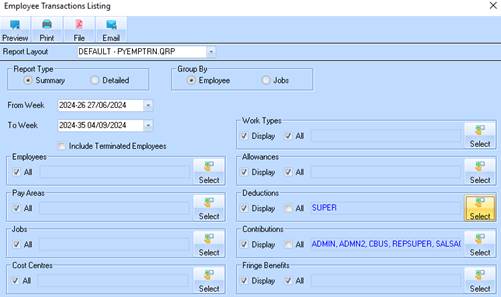

Fig 17 - Employee transaction Listing

The Report Sum Total should match the CSV file total displayed. In this sample the total should matche the CSV control total. (See Create Contribution CSV file)