Should you invoice a client and receive funds transfer in a foreign currency you will need to make adjustments upon receipt as the sum will not match the $A amount on the invoice.

This is a straightforward process of making a debit or credit adjustment to reconcile the difference between the actual sum received and the invoice amount.

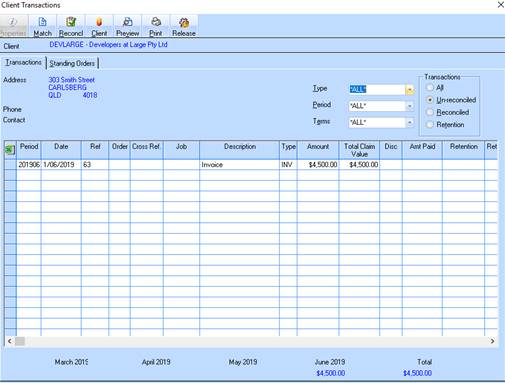

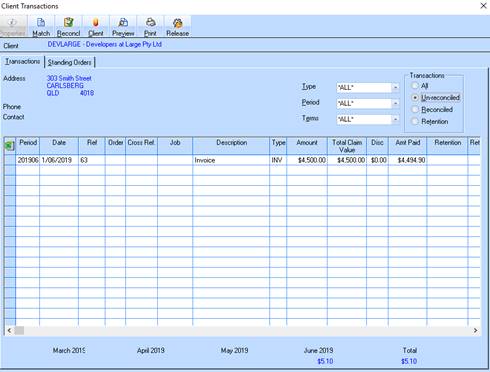

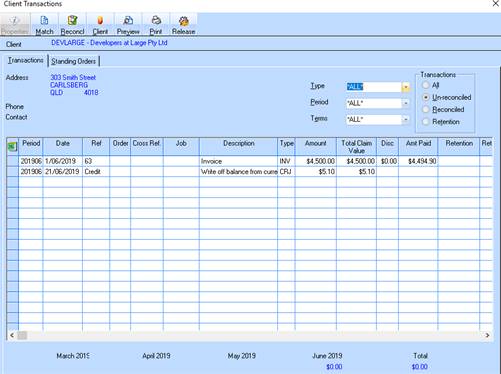

See the example below where the amount received is less than the $A invoice amount due to exchange rate differences.

1. Client Invoice is $4,500.00 Aus

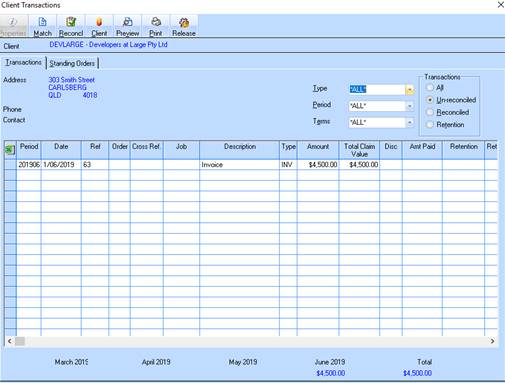

2. Dissect the lower receipt value to the invoice as normal

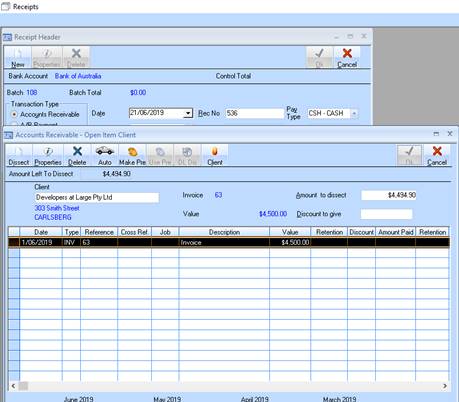

3. The unpaid value displayed is $5.10

4. Select the client and click on the Cr Jnl button (reduce client balance)

5. Select Period & Date. Enter a Reference & Description. Enter the Journal Value.

6. The first account in the bottom window will default to Trade Debtors.

7. You will need to enter the applicable account on the 2nd line eg Foreign Exchange gain/loss or whatever is appropriate. You can match the journal against the invoice in the allocation screen. If not done at this point you can using the accounts receivable matching process as shown below.

8. When completed click on the OK button.

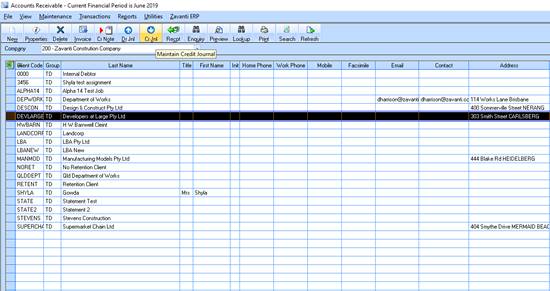

9. Go back into the Client Enquiry screen

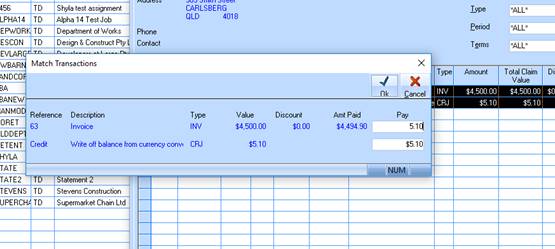

10. You will now need to Match the Journal to the Invoice if not allocated when creating the journal as noted above.

11. Enter the value of the Journal into the Pay box. Click on OK

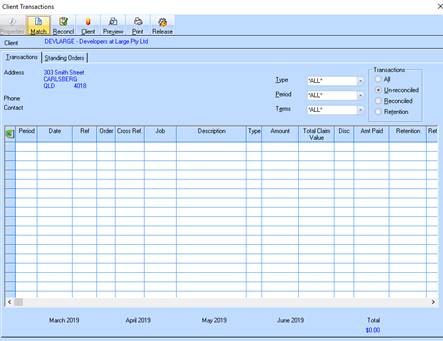

12. Your invoice is now reconciled.