When entering a job related AP invoice linked to Purchase Order, the system calculates the amount of retention to be held based on the following:

•Retention rules established for the PO

•Previous retentions already held against the PO

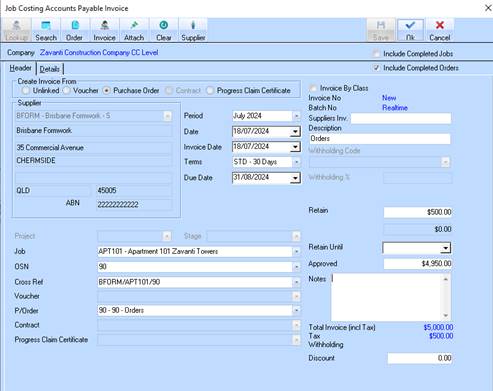

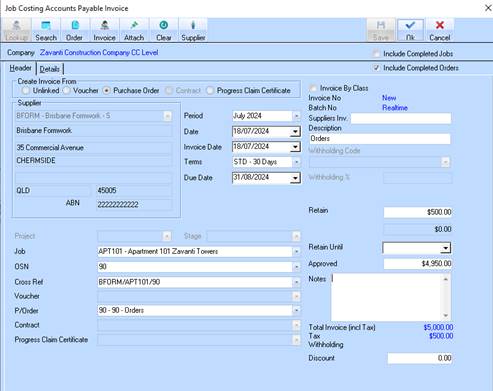

In the example below the invoice has been linked to a Purchase Order for $20,000. The following invoice is the first claim against this purchase order and is for $5,000. The details tab on the invoice has been adjusted accordingly, and the following calculation is displayed in the header.

The table below lists the Journals created by the above transaction, showing the distribution to the General Ledger accounts (as per the settings in section 2.1).

|

Account |

Account Name |

Description |

Debit |

Credit |

|

30100 |

Trade Creditors |

AP Invoice – Supplier Brisbane Formwork |

|

$4,950.00 |

|

10850 |

Work in Progress |

Formwork |

$4,500.00 |

|

|

30575 |

GST Paid |

Tax Payable - |

$450.00 |

|

|

30200 |

Retentions Payable |

AP Invoice - Retention |

|

$500.00 |

|

30386 |

Deferred COGS - AP Ret |

AP Invoice - Deferred Retention |

$500.00 |

|

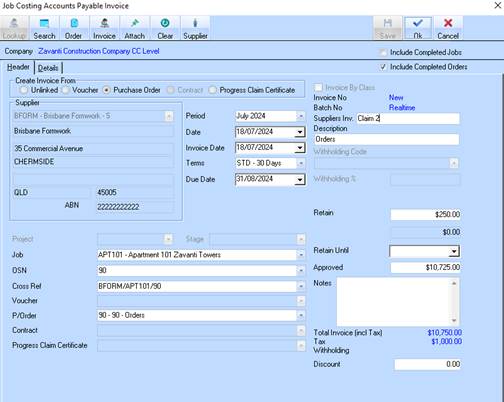

A second invoice is then entered for the remaining balance of the Purchase Order, $10,000. The invoice calculation on the “Header” tab is as follows:

Note the Retained amount has capped at the value of $250. This is due to the earlier invoice entry having already retained $500 (10% of $5000). The maximum amount of retention to be held on this purchase order is 5% of $15,000 = $750.

The rest of the calculation is as follows:

|

Invoice value |

$10,000 |

|

Retention (cap at 5% contract value) |

$250 |

|

Net payable |

$9,750 |

|

GST (10%) |

$975 |

|

Total payable |

$10,725 |

The table below lists the Journals created by the above transaction, showing the distribution to the General Ledger accounts (as per the settings in section 2.1).

|

Account |

Account Name |

Description |

Debit |

Credit |

|

30100 |

Trade Creditors |

AP Invoice – Brisbane Formwork |

|

$10,725.00 |

|

10850 |

Work in Progress |

Claim 2 |

$9,750.00 |

|

|

30575 |

GST Paid |

Tax Payable |

$975.00 |

|

|

30200 |

Retentions Payable |

AP Invoice - Retention |

|

$250.00 |

|

30386 |

Deferred Retention |

AP Invoice – Deferred Retention |

$250.00 |

|