There is no commitment source when entering job related AP invoices, thus retention values are derived directly from the supplier properties in Accounts Payable. Refer to section 2.2 for more information on setting up retention for suppliers.

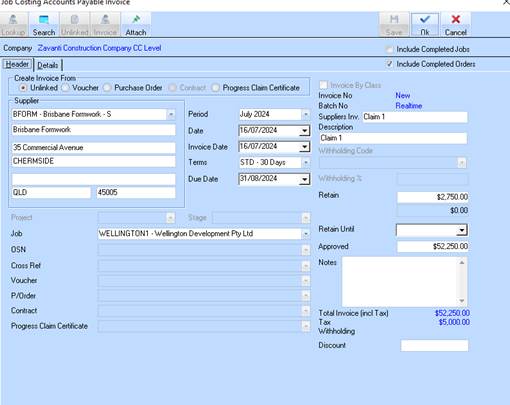

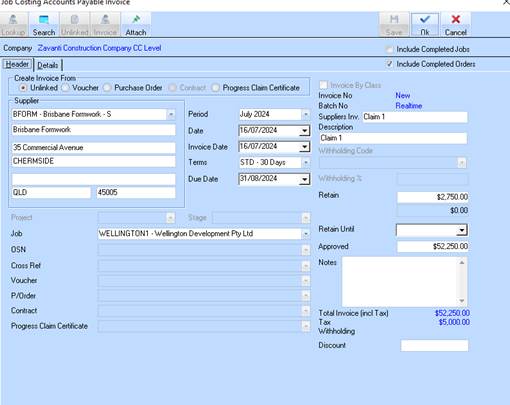

Note the invoice entered below.

The invoice has been entered for supplier Brisbane Formwork, previously set up with the standard retention rules (10% until 5% of contract). The invoice was entered for a total of $50,000 excluding GST.

1. On the invoice “Header” tab, note how the system has calculated the retention value of $2750 (5% of the claimed value).

2. The $2750 was deducted from the claim value ($50000).

3. The GST is the applied to this amount, becoming a total tax value of $5000.

4. The net invoice payable is then $52250, as per the screenshot above.

The table below lists the Journals created by the above transaction, showing the distribution to the General Ledger accounts (as per the settings in section 2.1).

|

Account |

Account Name |

Description |

Debit |

Credit |

|

30100 |

Trade Creditors |

AP Invoice – Brisbane Formwork |

|

52250.00 |

|

10850 |

Work in Progress |

Claim1 |

50000.00 |

|

|

30575 |

GST Paid |

Tax Payable |

5000.00 |

|

|

30200 |

Retentions Payable |

AP Invoice - Retention |

|

2750.00 |

|

|

|

|

|

|

Note that the amount of GST is only applicable to the claim before retention deduction.