Default settings need to be established for each component of the system as follows.

•Job Costing

•Accounts Receivable / Accounts Payable

•Before / After Tax

•Nomination of General Ledger Accounts

•Rules of Retentions

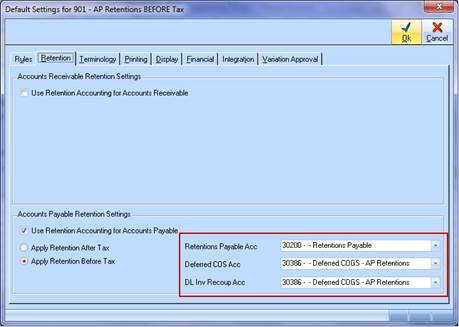

1. Retention settings are held in the Job Costing Module under the menu path Maintenance > Defaults.

|

Item |

Explanation |

|

Use Retention Accounting for Accounts Payable (tick box) |

Used to control whether retention is applied to the Accounts Payable invoice process or not |

|

Apply Retention After Tax (radio box) |

Used to ensure the retention process is applied after tax has been deducted |

|

Apply Retention Before Tax (radio box) |

Used to ensure the retention process is applied before tax has been deducted (please note – this is the required option for this training manual) |

|

Retentions Payable Acc |

The selected General Ledger account will hold the retained values from any claims or invoices that are processed. This is normally a liability type account in lieu of the fact that these sums are payable at the end of the retention period. |

|

Deferred COS Acc |

The selected General Ledger account is used to offset the retained amount as the Cost of Sales are not yet recognised in the Profit & Loss (as tax has not been paid on the retained amount). |

|

DL Inv Recoup Acc |

Applicable only to Development Ledger users. If this module is not in use, select the same account as per the Deferred COS account (mentioned previously). |

|

For Development Ledger users, this account is used to reduce the amount of capitalised inventories written into the General Ledger. This reduction account is not required for Job Costing transactions as Job entry transactions only have one WIP account, but Development Ledger may have many. |

|

|

|

Although the Job Costing defaults control whether retention is used or not, retention percentages will need to be applied to each individual commitment or transaction. These retention parameters are then used during the progress claim/invoice entry process. |