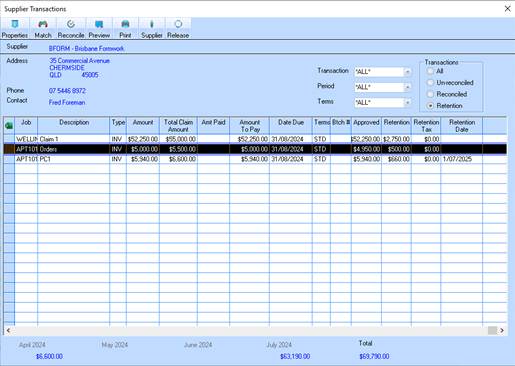

To release any retention, filter the transactions using the Retention Radio Button and simply highlight the invoice to be released and click the ‘Release’ button at top of screen. The retention release window will appear.

The below example displays the process from invoicing to retention release and reporting

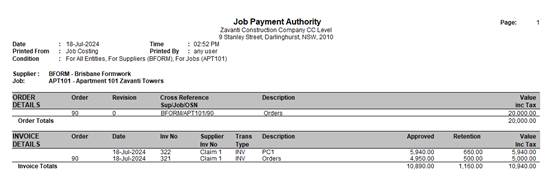

Below is shown sample reports supporting the Supplier Retention

Accounts Payable Retention Release will be done from the Supplier Enquiry Window

Highlight the retention line to be released and click on the ‘Release’ button

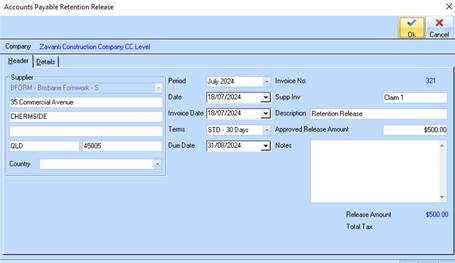

The full release value is defaulted. In the sample below 50% is to be release

The Retention Release window has two sections, “Header” and “Details” tab.

On the “Header” tab the user can set the date/period of the release and adjust the ‘Approved Release Amount’ to allow for partial release of retention (i.e. upon practical completion).

The “Details” tab displays the journals that will be created by the transaction. In the below sample GST was not applied as full GST had been applied to the original invoice.

|

Account |

Account Name |

Description |

Debit |

Credit |

|

308830 |

Trade Creditors |

AP Retention Release - Supplier |

|

$250 |

|

308835 |

Retentions Payable |

AP Retention Release - DEFAULT SUPPLIER |

$250 |

|

|

309020 |

GST Paid |

AP Tax Retention Release - DEFAULT SUPPLIER |

$0 |

|

|

71000 |

Deferred COGS - AP |

AP Deferred Retention Release - |

|

$250 |

|

110000 |

Work in Progress |

AP Retention Release - DEFAULT SUPPLIER |

$250 |

|

An examination of the journals will show that the ‘release’ has done primarily two things:

•Moved the released value from the ‘Deferred COS’ account to the WIP account as the cost can now be recognised (and written off) as COGS

•Moved the retained value from Retentions Payable to Trade Creditors as it is now payable AND attached GST on the released value.

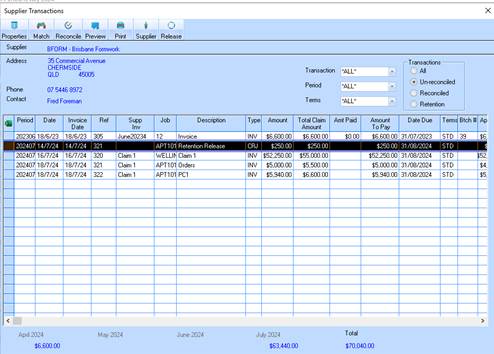

The Supplier Enquiry displays the following once the release transaction has been completed:

CRJ Transaction from Retention Release is now available for payment to the supplier

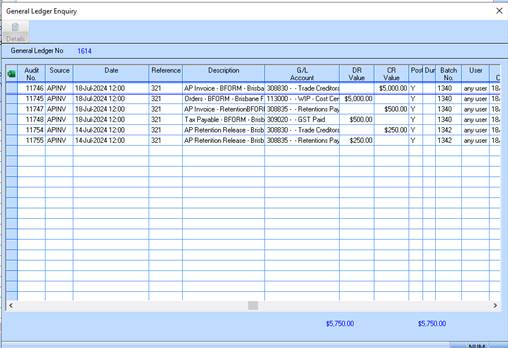

Drill down onto the original invoice will now display the associated general ledger transactions associated with the retention release

![]()

The remaining 50% retention is now displayed against the original invoice in the supplier enquiry.

When processing a payment for the retention release the payment is dissected to the CRJ transaction.

The release button only applies to invoices that have had retentions held.

|

|

Unlike previous versions, the “Amount” column will only display the payable amount of the claim. This coincides with the fact that the retained value is no longer held within the Trade Creditors GL control account. |